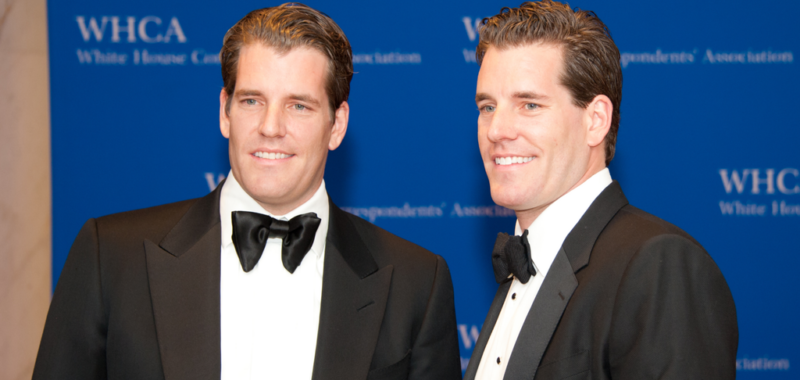

The Gemini Trust Company, the firm behind the Gemini crypto exchange founded by Tyler and Cameron Winklevoss, has agreed to pay a $5 million civil penalty to settle a Commodity Futures Trading Commission suit that alleged it misled regulators, court documents filed Monday show.

Monday’s proposed settlement helps Gemini avoid a trial that was set to begin on January 21. Gemini did not admit or deny wrongdoing in the settlement. Bloomberg first reported the news.

The CFTC sued the crypto company in 2022 for “making material false or misleading statements” in an effort to gain approval for its Bitcoin futures product.

Gemini “knew or reasonably should have known” that the statements and information by the company were false or misleading regarding how a proposed Bitcoin futures contract could be susceptible to manipulation, the 2022 lawsuit alleged.

In the world of derivatives, the futures market is the business of betting on the future price of an asset such as Bitcoin.

The first ever Bitcoin futures contract to trade on the Cboe Futures Exchange back in 2017 used price data from the New York-based Gemini.

Gemini offers digital asset services including an exchange and custody service.

The crypto mogul Winklevoss twins donated millions of dollars to President-elect Donald Trump’s campaign last year, claiming it would put an “end to the Biden Administration’s war on crypto.”

Under Democratic President Joe Biden, regulators hit crypto exchanges and other businesses in the space with a litany of lawsuits.

Edited by Andrew Hayward

Editor’s note: This story was updated after publication with additional details.