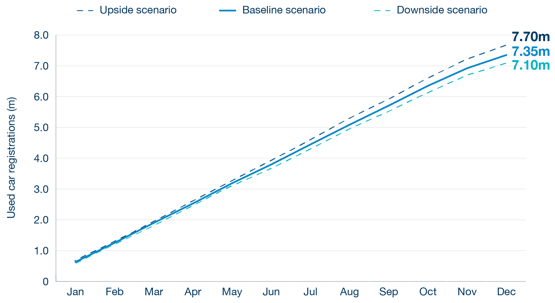

The used car market could see up to 7.7 million transactions by year-end if trading continues at Q! pace, according to Cox Automotive’s latest forecast.

However, Insight director Philip Nothard cautions that while Q1 matched Cox Automotive’s upside forecast for the three-month period, its baseline forecast of 7.4 million units remains the most likely outcome for the full year.

“The SMMT’s official used market figures for Q1 rightly give cause for celebration,” he said. “The market grew 6.5% to almost two million units, the fifth successive quarter of growth and a five-year high. The actual number of transactions was within a whisker of the upside forecast of 1.96 million we published last October.

“This bounce could lead us to conclude that our upside scenario is now the most likely to play out by the end of December. However, while I’d be delighted to see the number of transactions exceed our predictions, I think it’s important we don’t get ahead of ourselves, and I instead remain ‘cautiously optimistic’.

“When looking at the used market, we must always have one eye on the new, which is experiencing significant volatility right now. And, despite recent positive economic headlines, the cost-of-living crunch remains very real for many people.

“Interest rates remain high, and with a general election due, consumer appetite for anything perceived as a risk is low. For these reasons, we believe our baseline forecast should remain the guideline for quarters two, three and four rather than the more optimistic upside.”

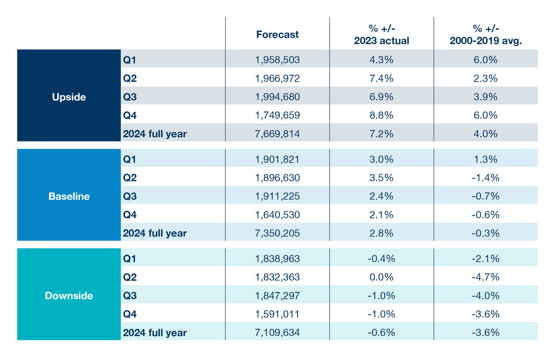

Cox Automotive’s adjusted full year used market forecast has been published in its new Insight Quarterly report. The forecast offers baseline, downside and upside scenarios, with the baseline the most likely scenario to materialise. This predicts 1,896,630 transactions in Q2 (versus an upside scenario of 1,966,972 transactions), and 7,350,205 for the full year (versus 7,669,814).

Its upside forecast for Q1 was 99.5% accurate to the SMMT’s actuals, published last week.

Nothard adds: “Dealers would do well to reflect on issues currently affecting new and keep these, as well as price volatility, front and centre. What’s happening in new will always become a hurdle for used operators further down the line.

“OEMs are currently having a torrid time grappling with the switch to EV, the ZEV mandate, new market entrants and spiralling costs. Price adjustments have become a key defence strategy, leading to the return of a push market, making the reliable prediction of residual values and, in turn, fleet company defleet strategies very challenging.

“Couple this with the possibility that several manufacturers may withdraw ICE models from their line-up to overcome the risk of non-compliance with the ZEV mandate, and it becomes clear why caution is advised.”

Nothard advises used car dealers to remain alert and agile; with the ICE car parc ageing year-on-year, they should embrace hybrid and EV models within their stock mix.

“News via the SMMT that used zero-emission car sales are up 71% only adds urgency to the need for more dealers to assess their stock mix. There is a noticeable lack of EVs and hybrid variants on too many used car forecourts. This sector is becoming increasingly competitive with each passing month, but how many dealers are ready for what’s coming down the pipe?”

“The gradual reduction in the number of petrol and diesel registrations is impacting availability and choice in vehicles up to four years old. We predict diesel’s share of the new car market will plummet to 3% by 2028. Retailers should, therefore, consider how their forecourt looks now, what percentage of it is ICE and how that will look a year from now and in the years that follow. Can that profile be sustained when the availability of ICE vehicles is shrinking at a rate of 10-16% a year going forward?”

Cox Automotive’s full used market forecast and commentary can be read in the launch issue of Cox Automotive’s Insight Quarterly.