Mercedes-Benz GLB Class was the hottest used car of 2024, selling in just an average 16 days with the German brand also securing the second spot with the A Class selling in an average of 16.5 days, according to online marketplace Auto Trader.

The Mercedes-Benz models significantly outperformed the average used car which sold in approximately 30 days last year.

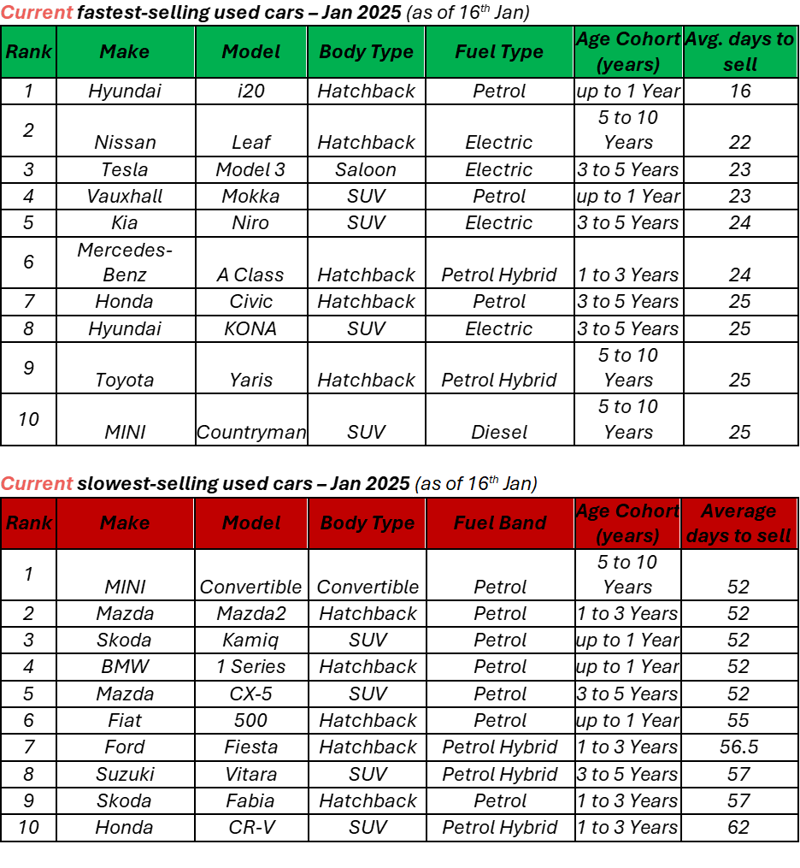

Overall used cars drove off forecourts two days faster than in 2023. This momentum has carried into 2025, with cars currently selling in about 39 days – three days quicker than the same period last year. January 2025 has marked the fastest start to the year since Auto Trader began tracking sales in 2019.

Mercedes-Benz GLB Class was the hottest used car of 2024, selling in just an average 16 days with the German brand also securing the second spot with the A Class selling in an average of 16.5 days, according to online marketplace Auto Trader.

The Mercedes-Benz models significantly outperformed the average used car which sold in approximately 30 days last year.

Overall used cars drove off forecourts two days faster than in 2023. This momentum has carried into 2025, with cars currently selling in about 39 days – three days quicker than the same period last year. January 2025 has marked the fastest start to the year since Auto Trader began tracking sales in 2019.

Electric vehicles (EVs) emerged as the fastest-selling fuel type in 2024, taking a median of just 29 days to sell, compared to 30 days for petrol and 31 days for diesel cars. Demand for EVs accelerated in the second half of the year, with the average EV selling four days faster than in the first half.

In January 2025, used EVs are selling in 35 days – a day faster than January 2024 and nearly two weeks faster than January 2023, when they took 52 days to sell.

The fastest-selling segment of the market in 2024 was 3-5-year-old electric models, which sold in just 23 days. This trend continues into 2025, with these ‘middle-aged’ EVs selling more than a week faster than the average used car.

By contrast, ‘nearly new’ EVs (up to one year old) are among the slowest movers, taking nearly 42 days to sell, well above the average of 34 days for cars in this age group.

The gap in performance between younger and older EVs comes down to affordability. Auto Trader’s pricing data, based on over 800,000 daily retail market observations, shows that nearly new electric cars cost nearly double the price of 3-5-year-old models (£37,032 vs £19,386).

Crucially, 3-5-year-old EVs are now price-competitive with petrol cars of the same age (£18,345) and are significantly cheaper than diesel counterparts (£23,400).

The evolving affordability of used EVs highlights their growing appeal, as consumers increasingly prioritise value without compromising on sustainability.

Richard Walker, data and insight director at Auto Trader commented: “Despite general tight belting at the moment, car buyers were still happy to indulge in premium used cars last year. Not only did Mercedes-Benz top the list, but most of 2024’s hottest used cars were pricier SUVs.

“We’ve entered January with real momentum, following a very positive market performance last year. Cars sold at a rapid pace, demand was very robust, and prices were stable.

“But 2024 really was the year of the used EV, especially for those ‘middle-aged’ models which have become more accessible than ever, helping demand rocket over the last 12 months or so. It shows that when the price is right, car buyers are more than happy to make the switch to electric.”

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.