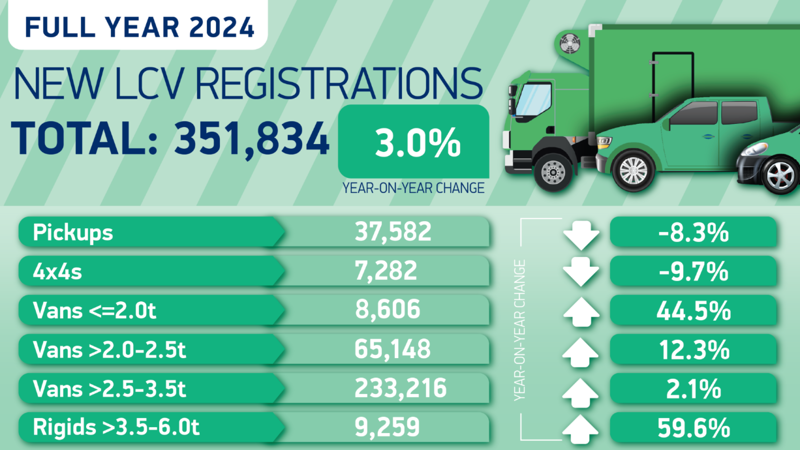

The light commercial vehicle (LCV) market posted a 3.0% growth in 2024, with 351,834 new registrations making it the best year for fleet renewal since 2021, according to the Society of Motor Manufacturers and Traders (SMMT).

Despite, December capping off the year with a robust 27,221 new LCVs registered, The UK’s ambitious targets for decarbonising the LCV sector depend on swift action to address key issues without which, the sector’s growth and its contribution to the UK’s net-zero goals could be at risk.

These include increased investment in charging infrastructure, regulatory flexibility, and targeted incentives to support the transition to zero-emission vehicles.

This growth was driven by increased demand across all van weight classes. Registrations of the largest vans rose by 2.1%, accounting for 66.3% of the market.

Medium and small-sized vans also saw substantial growth, with registrations increasing by 12.3% and 44.5% respectively. However, other segments struggled. New 4×4 registrations declined by 9.7%, and pick-up registrations fell by 8.3% to 37,582 units.

The drop in pick-up registrations is attributed to the UK government’s decision to tax double-cab vehicles as cars for benefit-in-kind (BiK) and capital allowance purposes starting in April. Industry leaders warn this change could significantly impact businesses relying on these vehicles.

“Businesses in farming, construction, and utilities face higher costs and may delay fleet investments, leading to older, more polluting vehicles remaining on the road,” said Mike Hawes, chief executive of SMMT. “This not only hampers progress towards decarbonisation but could also reduce tax revenues.”

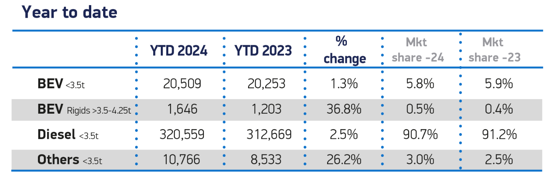

While battery electric vans (BEVs) showed a modest 3.3% increase in registrations to 22,155 units, their market share stagnated at 6.3%, well below the UK government’s Zero Emission Vehicle (ZEV) mandate target of 10%.

Hawes said improving infrastructure to meet ambitious targets was critical. “Vans, 4x4s, and pick-ups keep businesses moving, making this sector a barometer of the UK economy,” he said. “Buyer confidence will inevitably be undermined when charging infrastructure does not meet fleet needs. A review of EV regulation is crucial to reflect market realities and ensure ambitions are deliverable.”

Hawes said improving infrastructure to meet ambitious targets was critical. “Vans, 4x4s, and pick-ups keep businesses moving, making this sector a barometer of the UK economy,” he said. “Buyer confidence will inevitably be undermined when charging infrastructure does not meet fleet needs. A review of EV regulation is crucial to reflect market realities and ensure ambitions are deliverable.”

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), echoed these concerns. “BEVs accounted for just 6.3% of the market, far below the ZEV mandate target. This is troubling as fines for non-compliant vans will double to £18,000 in 2025, alongside a 16% target increase,” she said.

Robinson also highlighted disparities in charging infrastructure for vans. “Many van drivers lack access to home charging, and on-street infrastructure is inadequate. Greater attention must be given to supporting van operators,” she stated.

Despite these challenges, the market for lightweight vans up to 2.0 tonnes showed a promising 44.5% growth in 2024. “These vehicles, commonly used as service vans, indicate growing confidence in this sector of the economy,” Robinson noted.