Only one in 10 emergency Covid loans issued to building companies have been paid back, Construction News can reveal.

As the fifth anniversary of the first Covid lockdown in the UK approaches, an investigation by CN has shown that just 30,282 (11.6 per cent) of the 260,912 loans issued to small construction businesses have been fully recouped.

Under a Freedom of Information request, data obtained from the British Business Bank also revealed that almost a third of small construction firms – some 75,464 – had defaulted on their bounce back loan repayments within the past five years. As of 31 January this year, 12,589 were still in arrears.

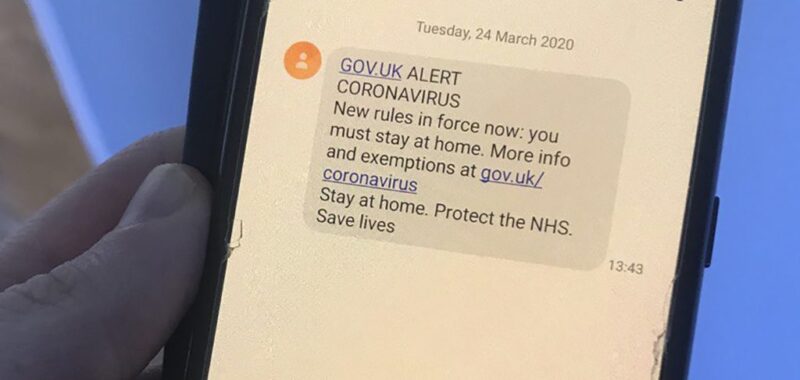

The bounce back loans were introduced by the government in the months following the first lockdown, allowing small businesses to access up to £50,000.

Companies with a turnover of up to £45m were able to unlock up to £5m under the Coronavirus Business Interruption Loan Scheme (CBILS).

CBILS loans, introduced in April 2020, came with 80 per cent government guarantees for lenders; bounce back loans, which began in May 2020, had 100 per cent guarantees in place.

The figures showed only 37 per cent of the 14,688 CBILS loans obtained by construction companies had been paid back to date.

By the end of January, 1,655 businesses had defaulted on CBILS loans, while 190 remained in arrears.

In April 2020, Sean Tucker, managing director of Lincolnshire-based contractor Evergreen, told CN that pandemic-induced trading conditions meant his business was going to run out of money within two months.

He later secured an £80,000 CBILS loan and transformed the company’s business model, switching to management contracting rather than design and build.

Speaking to CN this month, Tucker said Evergeen had paid off its CBILS loan.

However, its sister development company Goodwin & Tucker, which he runs, is still paying off its CBILS loan.

“We took those loans out to keep ourselves going and they’ve been a big cost to us,” he said. “You just can’t expand a business while you’re paying off those loans. You’re going to work to pay back the loans that you took to keep the company going in the first place. When we finally pay it off, it will mean we can invest back into the business.”

Four years on, and buffeted by rising costs since the outbreak, he has not returned to contracting, only taking on new-build jobs for a select few clients.

“We’re developing industrial units and we’re pushing our architectural and project management consultancy side because we just couldn’t control [costs on] the contracting side of it,” he said.

DRS Bond Management managing director Chris Davies said the statistics were “pretty damning”.

“Some of the people who got these loans would not have got them under normal monetary circumstances because the banks don’t lend [much] to the construction industry and unfortunately this underscores why they don’t,” he said.

On the low proportion of loans that had been fully repaid, he added: “It’s a forgotten debt burden. Covid now seems like a lifetime ago, but people are still carrying the legacy of it on their balance sheet.”

Construction Products Association head of construction research Rebecca Larkin said material inflation, fuel, energy and labour costs had rocked the industry in the years since 2020.

“For a construction firm working in a sector where growth has been slower to return, or dropped off sharply over the past 18 months, such as housebuilding or large home improvements, this combination will have squeezed balance sheets and left little spare for loan repayments.

“Linked to this, construction insolvencies have reached the highest level since the global financial crisis over this period too, and the knock-on effect to those firms still active will also have constrained finances, with smaller businesses and specialist contractors – most likely to have been recipients of the bounce back loans – the worst hit,” she said.

Tucker said if the loans had not been issued the sector would have been in dire straits, but the long term effects are stark.

“No wonder we’re finding everything has to go up – planning costs, national insurance costs, all the other changes, they’re having to recoup that money from somewhere,” he said.

He called on policymakers to see the benefits the building industry brings to the country. “We’ve been through a lot of trauma and it needs time to heal,” he said.

“We can’t keep having more and more red tape and more taxes put on us because it’s just more bills to pay.”